In Watermark’s Interim Executive Annual Survey 2020, right in the middle of COVID-19 lockdown, we asked our interim executives to answer some questions pre-emptively based on the rapidly changing face of business. A few months on, we polled these same questions on LinkedIn to see what has changed and what has remained the same in the last few months. These are the results.

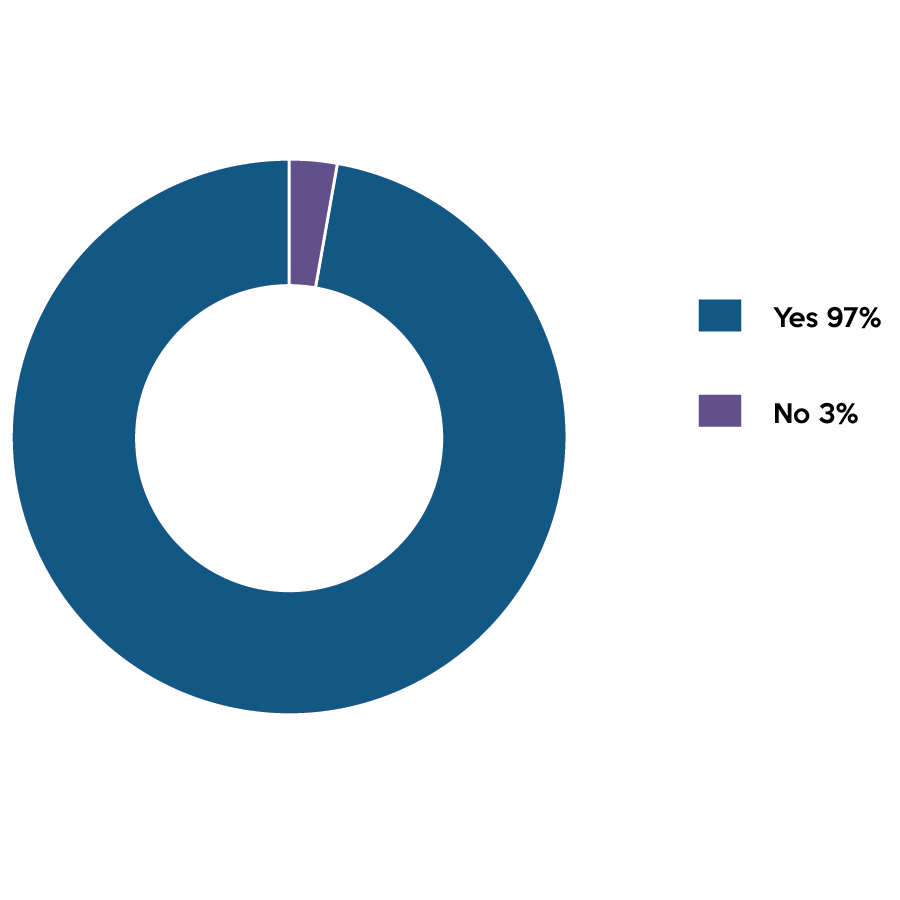

1. Do you see interim executives as a way to bring short term relief to corporates as they face ongoing economic uncertainty and the flow-on effects?

Interim Survey - Mar/Apr 2020 | LinkedIn polling series - Oct/Nov 2020 |

|  |

A few months on from lockdown still expresses an overwhelming positive response to this question. 97% of respondents believe that interim executives will provide relief through this economic uncertainty. This mirrors what we are seeing at Watermark, with the interim business thriving through COVID-19. Through this period, not one of our interim executives were let go from their roles, in fact many contracts were extended.

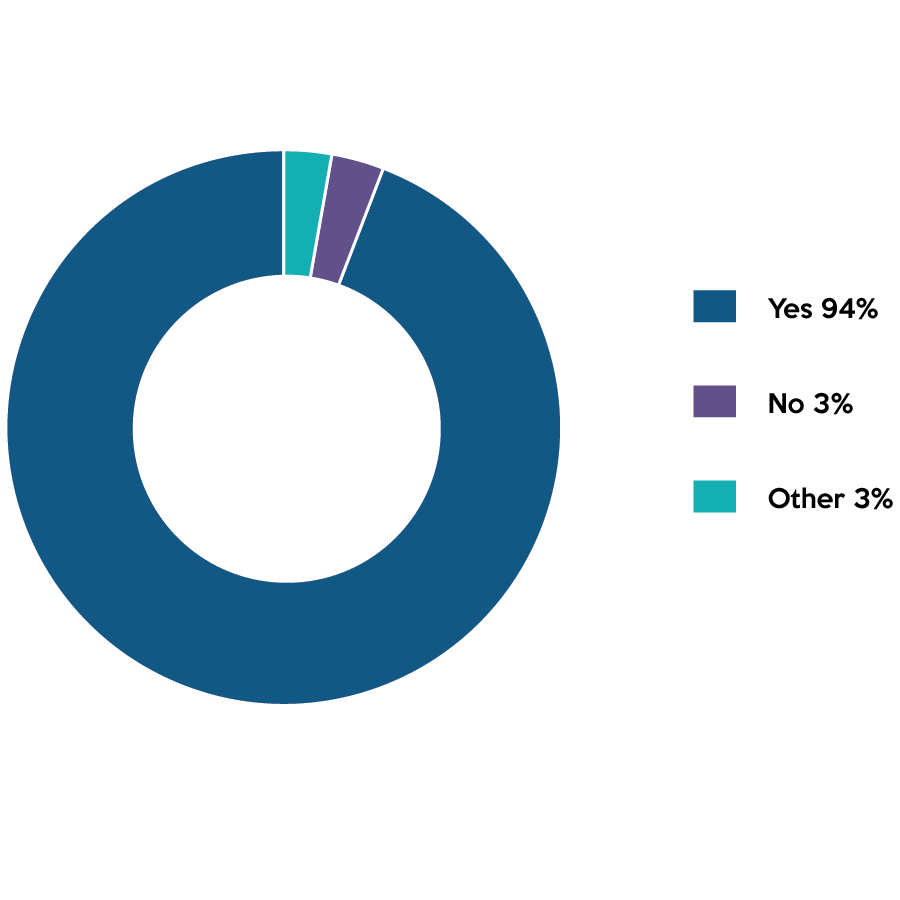

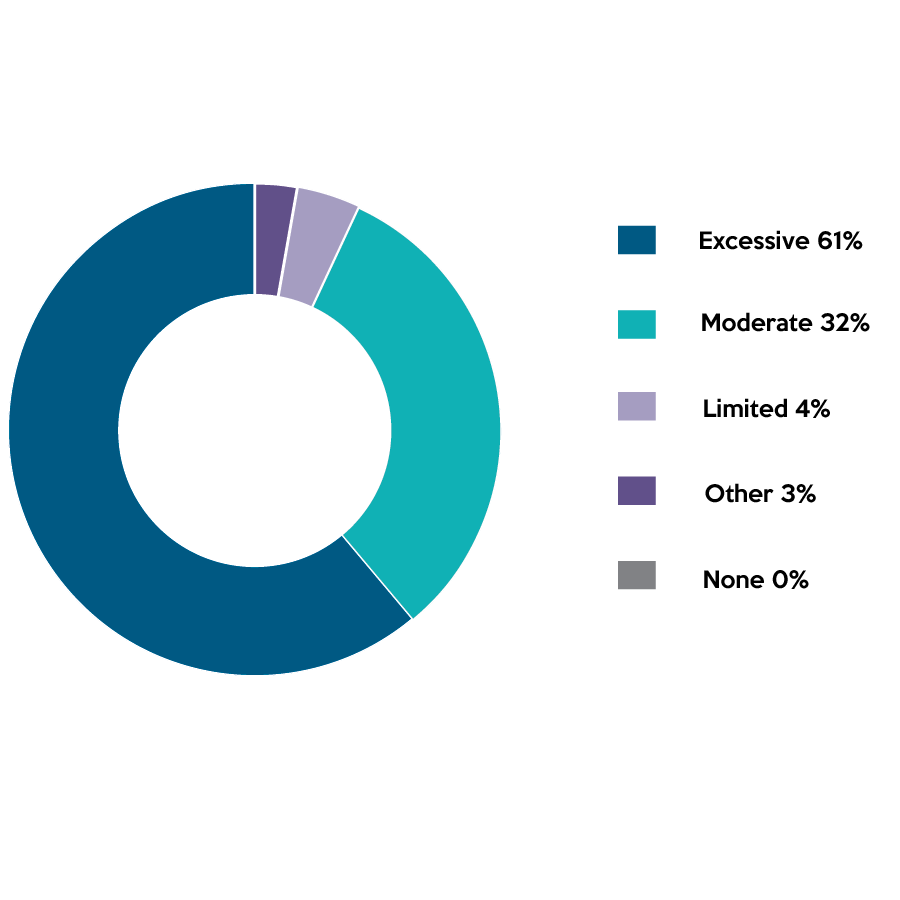

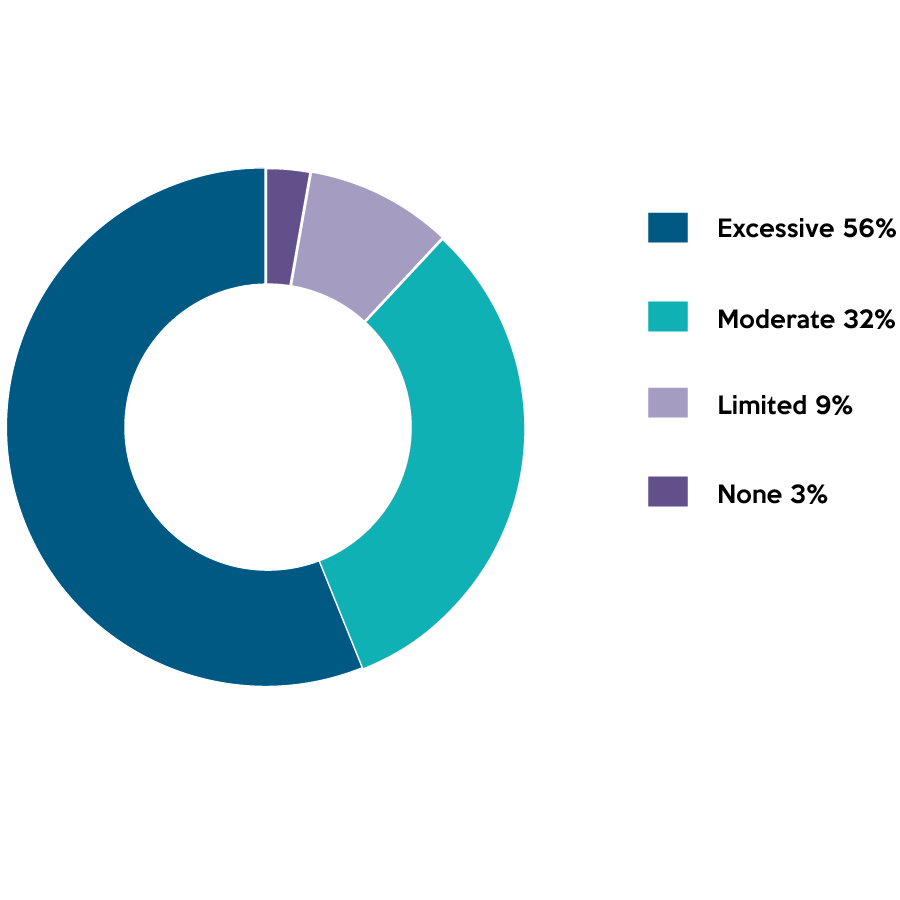

2. To what degree have you observed economic instability in the last 6 months (driven by severe weather events such as fires and floods, COVID-19, stock market instability, low inflation/interest rates) impacting business decision making?

Interim Survey - Mar/Apr 2020 | LinkedIn polling series - Oct/Nov2020 |

|  |

Very similar results for this question when comparing Mar/Apr with Oct/Nov. Results still suggest that instability has impacted decision making to an excessive to moderate degree. Interestingly, more respondents have answered that they have observed limited to no impact on decision making in Oct/Nov suggesting that some businesses may be starting to heal from the instability or alternatively the LinkedIn polling series has captured more respondents from sectors that did not see an impact e.g. technology.

3. For what period of time do you predict this instability will continue?

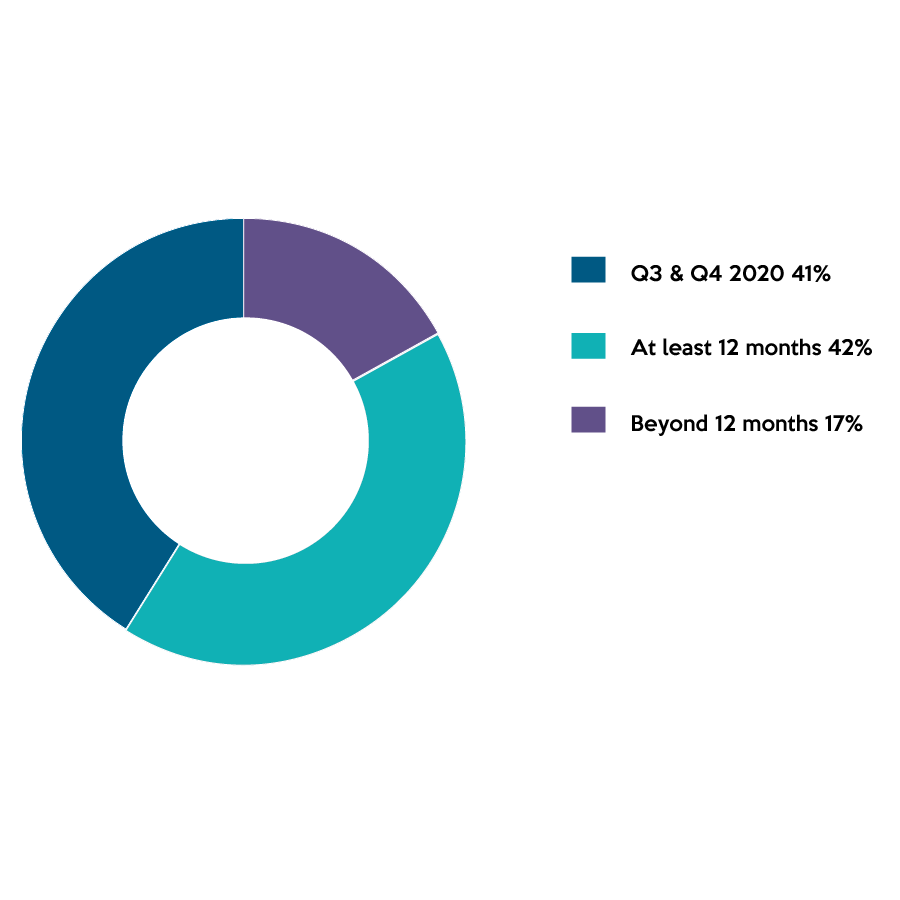

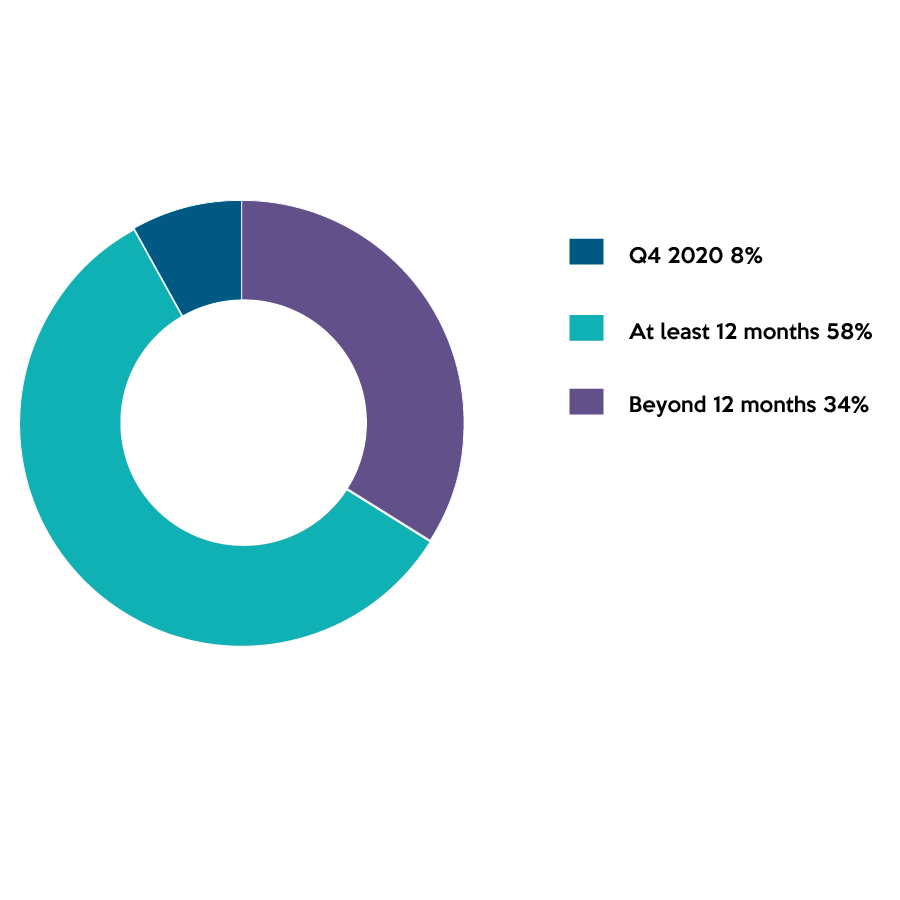

Interim Survey - Mar/Apr 2020 | LinkedIn polling series - Oct/Nov 2020 |

|  |

As we have now entered Q4 of 2020 it is clear to respondents that this instability will continue beyond 2020. More respondents now believe it will even continue beyond 12 months highlighting the massive economic fallout due to COVID-19 for both individuals and businesses and the long-term effects of this.

4. How are organisations currently addressing the skill gaps in these key departments?

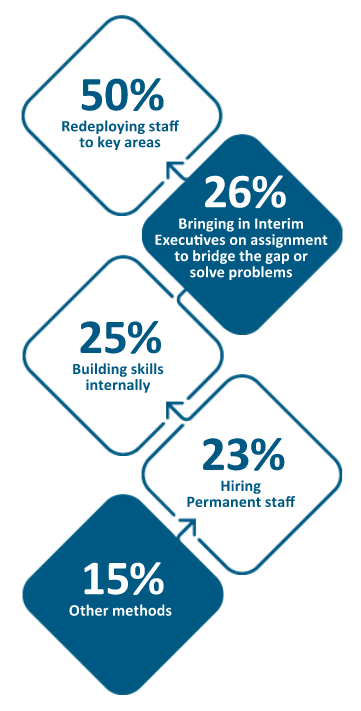

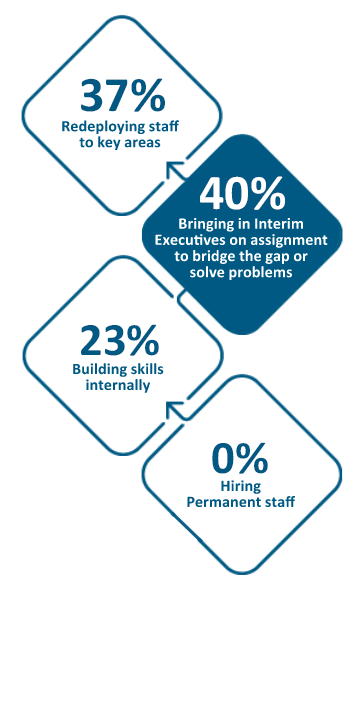

Interim Survey - Mar/Apr 2020 | LinkedIn polling series - Oct/Nov 2020 |

|  |

From Mar/Apr to Oct/Nov there has been a shift from redeploying staff to key areas, in order to address skill gaps, to utilising interim executives. This may be due to organisations now being more confident to spend money on solving the problems they have due to COVID-19 and looking to create their “new normal” with the help of external interim executives. There is also risk involved in putting undue pressure on employees by redeploying staff and not backfilling roles during an already overwhelming and stressful time due to the pandemic. Organisations may now be aware of this and are utilising interim executives to avoid this risk.

Further, in Oct/Nov, 0% of respondents believe that organisations are hiring permanent staff to address skill gaps. Clearly there is permanent executive recruitment happening in the market however, more organisations are favouring interim as a viable solution now. This may be due to hiring an interim executive allowing organisations to respond very quickly to the volatile economic environment. At Watermark, we can turn a client brief into a successfully placed interim candidate within just a number of days which allows projects to be started extremely quickly. The shorter-term length of assignments by interim executives also allows better control to manage the environmental and economic risk by assessing and committing to next steps pending where the organisation and economy are at. As there becomes more certainty in the economic/business landscape, we may see more permanent hiring again as a way to address skill gaps.

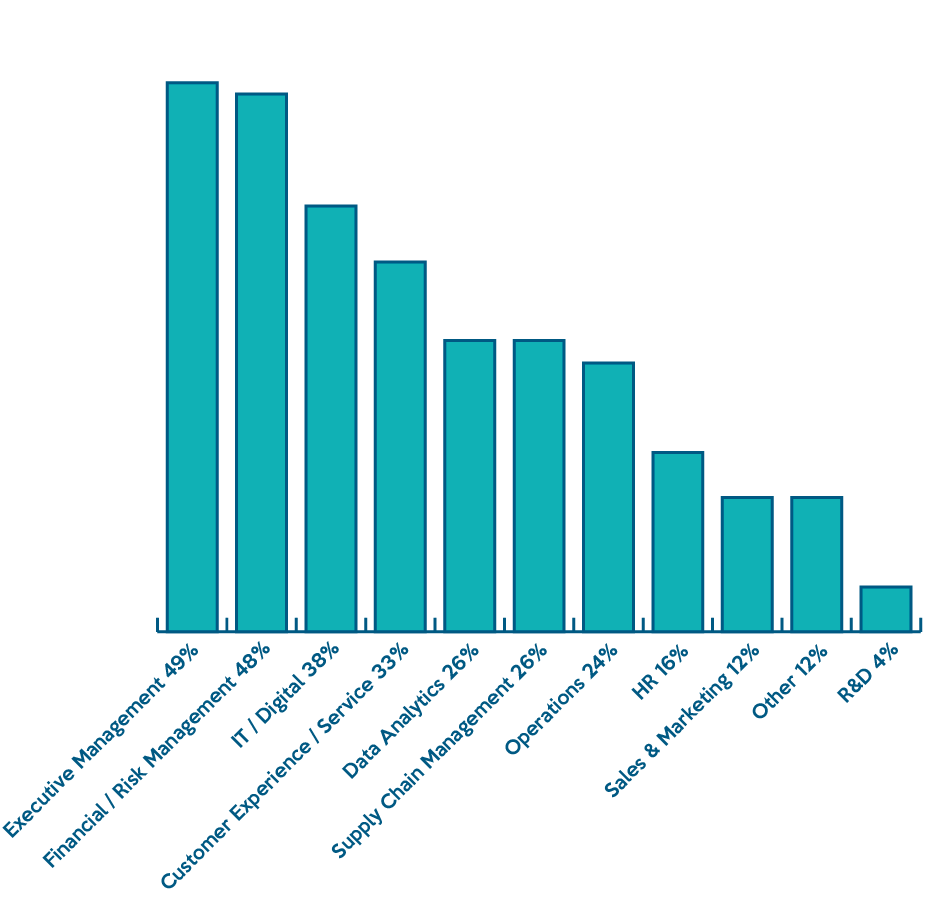

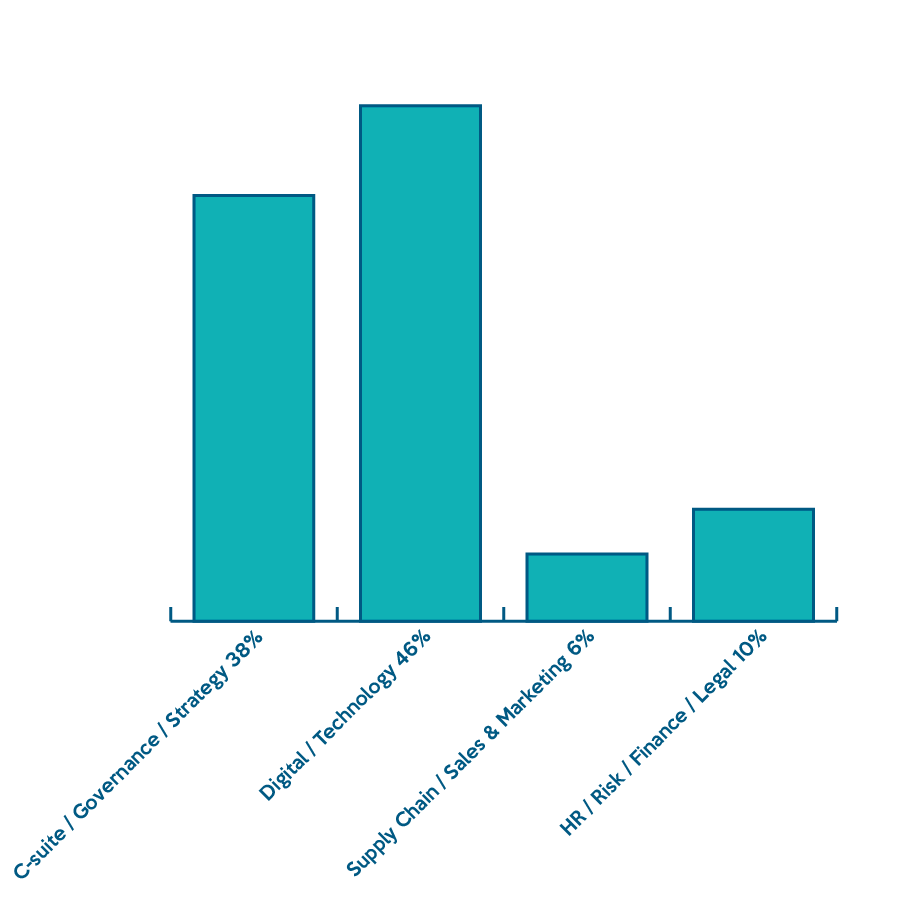

5. In your opinion, what are the top three business areas requiring urgent attention to address skill gaps in 2020 and beyond?

Interim Survey - Mar/Apr 2020 | LinkedIn polling series - Oct/Nov 2020 |

|  |

In Oct / Nov 2020, Digital and Technology has overtaken Executive Management / C-Suite / Governance / Strategy as the top business area requiring urgent attention to address skill gaps. COVID-19 rapidly accelerated the need for digital transformation as organisations scrambled to manage this crisis; both setting up workforces remotely and delivering e-commerce solutions. The success of these transformations has proven to executives that organisations can trust their technologies and the skills of their employees to not just digitally transform but to do so quickly. It has proven that organisations do not need to wait for a crisis to build on their technology capability, but they can plan and invest in their technologies and technical skills of their people across all functional areas. These are now seen as a necessity of operating and a priority for success. While leadership skills are important, without the ability to digitally transform at a rapid pace, organisations will be left behind in this new world of work.

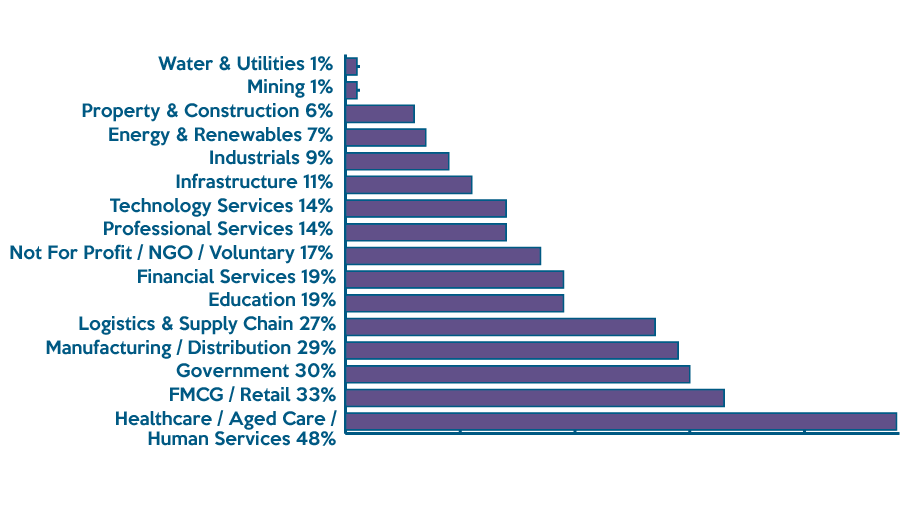

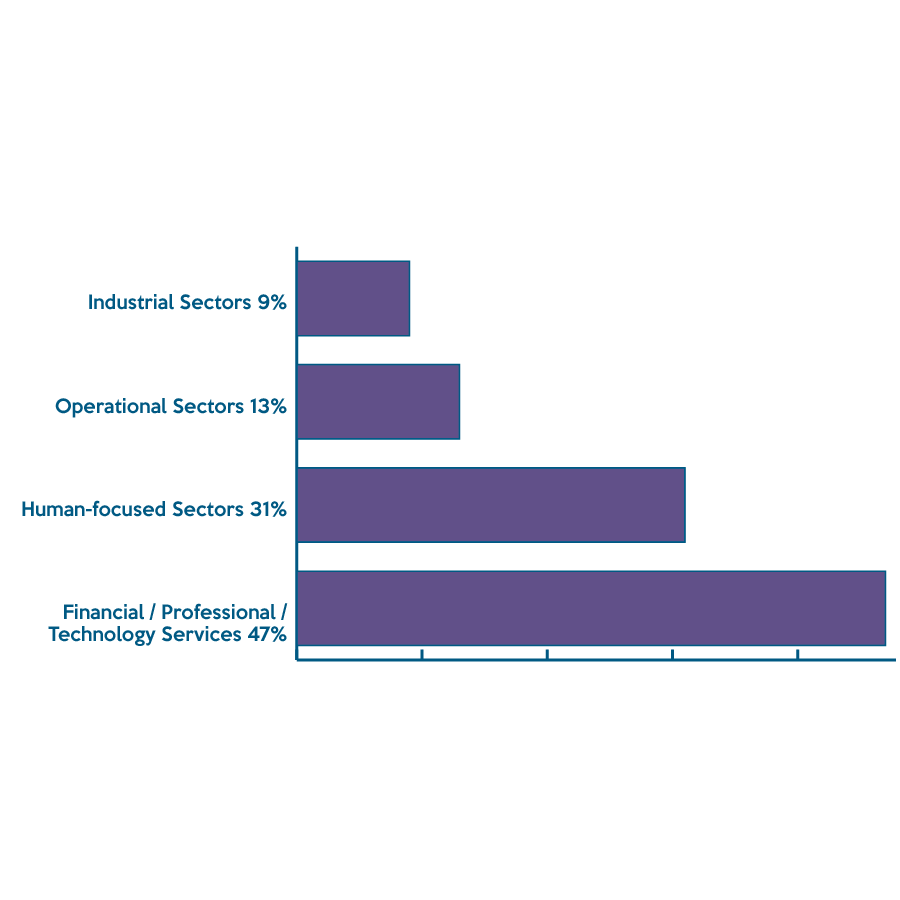

6. As companies recover from this economic instability, in your opinion, what industries will have the highest need for Interim Executives?

Interim Survey - Mar/Apr 2020 | LinkedIn polling series - Oct/Nov 2020 |

|  |

Financial / Professional / Technology Services (47%) and Human-Focused Sectors (31%) are the industries that respondents believe will have the highest needs for Interim Executives. These findings are in line with the interim roles we are placing at Watermark where Health, Financial Services and Insurance specifically are the top 3 sectors we have placed the most candidates in 2020.

To download the Interim Executive Annual Report 2020, please click here.