In May 2020 as Australians navigated a nationwide lock down and with businesses starting to experience the impact of COVID-19 on their organisation, we invited clients to complete a questionnaire to help us gauge the main areas of concern, following is a summary of the findings.

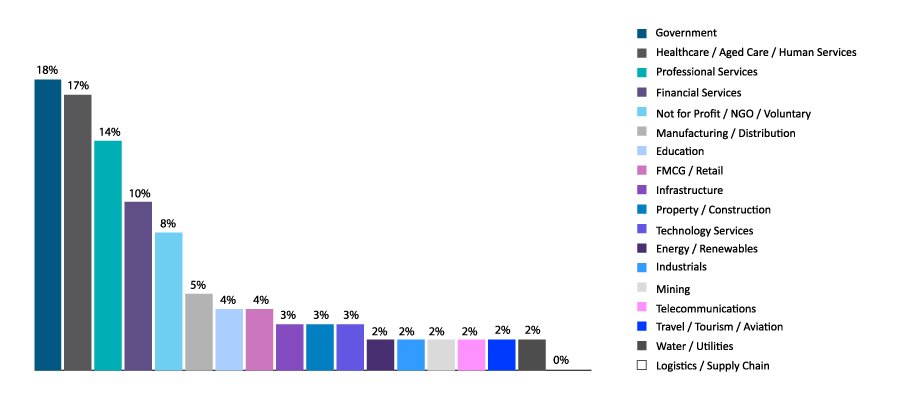

The responses came from clients in a wide range of industry sectors:

We began the process with a simple question, “what was keeping your organisation busy prior to COVID-19?” Unsurprisingly, business as usual was majority theme amongst participants, alongside this response was a continued focus on growth, mergers and acquisitions and future planning evidenced strongly as did drought and fire relief.

Most participants highlighted a changing focus towards planning and monitoring the impact of the crisis. Now three months on from the beginning of the crisis in Australia, planning is as important as it was at the height of the pandemic. Organisations are still taking considerable measures to plan for the proposed and potential impacts across organisational supply chains, finance and the workforce, as we transition towards an open economy with social distancing rules.

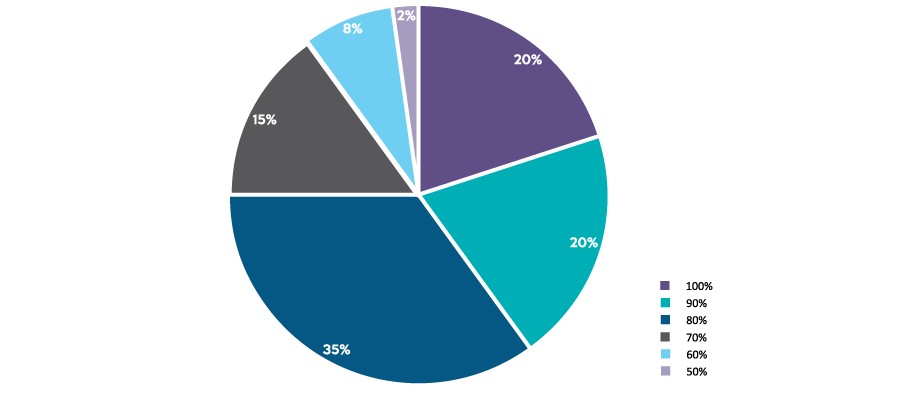

One of the questions we asked was “Do you expect business to return to the point it was before COVID-19 when Federal and State Government agree it is safe to return to work”? 80% of respondents thought that business would not return to the point of pre COVID-19, which demonstrates considerable uncertainty. Only 20% of respondents felt that it would return to the former normal.

% of business that will return post COVID-19

The response outcomes demonstrate considerable uncertainty around COVID-19. I think it’s reasonable to assume if we asked the same question today the outcome would reflect a greater sense of confidence.

From an M&A perspective we know from our conversations with managing partners that M&A quite literally fell off the side of a cliff. However, as with the GFC, M&A will return, albeit in a more subdued and measured sense over the coming months. Whilst it’s still unclear as to what this means for asset values and corporate valuations, future earnings are beginning to look a little clearer.

From a retail perspective, broader evidence is now demonstrating a return in traditional consumer behaviours, as evidenced by analysis of CBA's debit and credit card data, which shows total spending over the week to May 8 was down just 2 per cent compared to a year ago, a major improvement from mid-April when it was down around 20 per cent. (Source data: ABC News)

We asked clients “What are the three biggest current impacts of COVID-19 on your organisation?”

Not surprisingly remote working was the key finding, alongside this cashflow management, revenue impact and the necessity to adapt towards new working practices with an emphasis on technology.

We know for a fact that different organisations struggled to adapt to the new norm, critical infrastructure was tested to the limits, having said all that, corporations have demonstrated considerable resilience and adaptability towards this new norm.

Thanks to the likes of Zoom, Teams, Skype for business and WebEx, business has adapted exceptionally well, embracing disruptive technology to realise significant productivity gains.

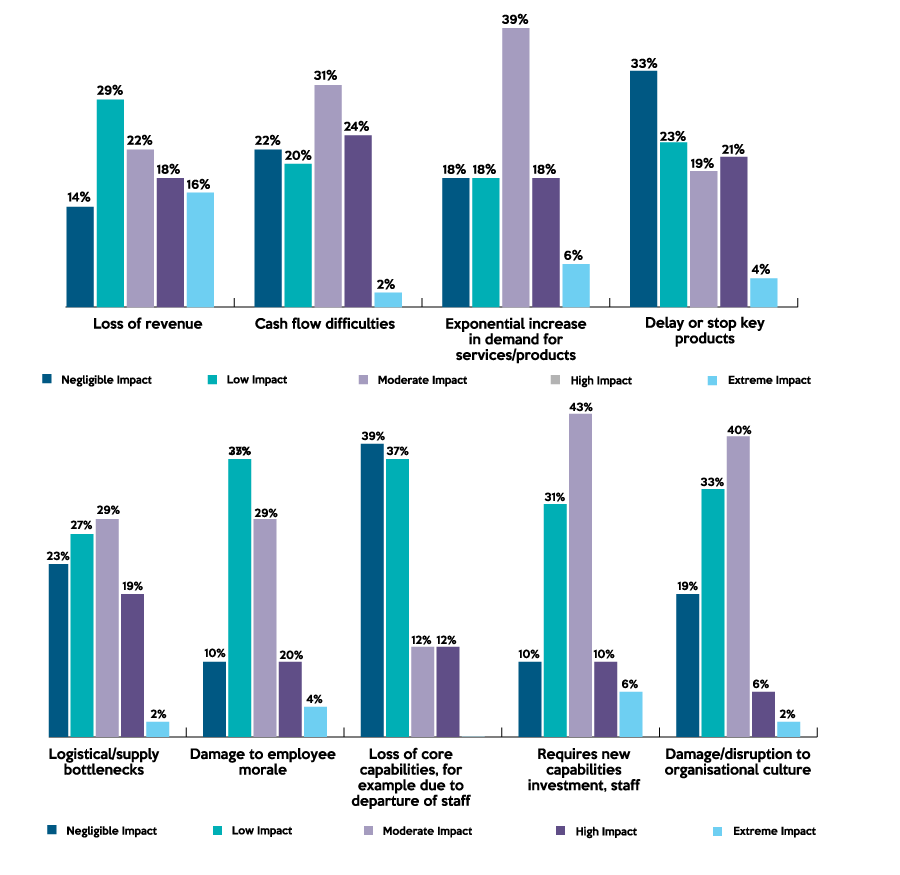

Further to the current findings, we asked our clients to think about the impact on their business over the next six months across a range of challenges.

The results highlighted that the majority of impacts were in the negligible to moderate range. As anticipated, impact on cashflow, employee morale and supply chains evidenced strongly in the results.

This leads us to believe that whilst the impacts have been far reaching economically, these businesses are well placed to recover from the pandemic as they have retained key, talented staff.

We asked clients to highlight the potential benefits and learnings which may emerge at an organisational level from the crisis.

Overwhelmingly the response centred on the adoption of work from home flexibility, traditional corporates who have struggled from a trust perspective have been forced into navigating flexible work arrangements. Additional responses included product development, reduced commuting time and improved work life balance.

The adoption of a remote workforce will undoubtedly have many impacts, positive and negative. On the positive side, if you consider aged care services for a moment, which account for over 1.2 million people in Australia, a movement towards remote working has the potential to significantly improve community aged care outcomes.

The final question we asked participants to answer was “What are the most impactful actions you are currently taking to deal with the crisis?”

The overwhelming response was direct communication, as the Pandemic fuelled uncertainty, leaders increasingly sought direct communication channels, to address remote teams and outline the path forward.

Executive Summary

Continued disruption to businesses and industry due to COVID-19 means the mid-term outlook remains uncertain. As the economy progressively re-opens and active cases of COVID-19 reduce, confidence will return.

In the coming months and year ahead, businesses and industry will be increasingly challenged on multiple fronts, leaders will have to navigate a transitioning economy, policy reform and remote teams, whilst also considering the future for the business environment.

A changing economy could be the catalyst for a new type of executive leader. Where organisations have traditionally favoured growth orientated, risk-positive leaders, the new environment may favour creative, solution orientated thinkers, equipped to make the most of scant resources and cultivate inclusive positive cultures.

It therefore follows that executive leadership appointments should be culturally accretive, demonstrate robust governance beyond the rolodex and hold up to rigorous, external scrutiny.

If you require any assistance or would like to decuss the above futher, please contact us here.